We rounded up the 3 best travel insurance plans and ranked them by cost, coverage, reviews, and extra options available. Find the perfect insurance for your trip by choosing from the best!

What’s the Best Travel Insurance?

- Pay attention to the cost, coverage, and plan options

- Look for companies with mostly positive reviews

- Pick plans that fit your needs and budget

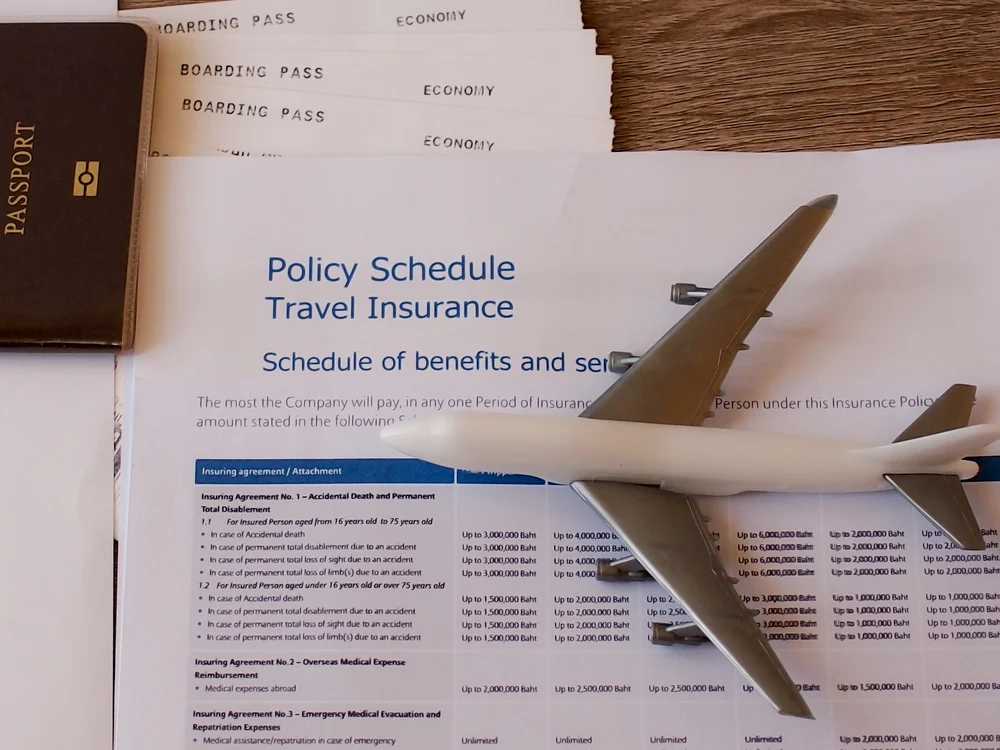

Travel insurance can really be a lifesaver – ask anyone who’s had to suddenly cancel a nonrefundable trip or dealt with missing baggage that never turned up.

But travel insurance plans are not created equally.

There are plans that offer extensive, 100% trip coverage and protection for just about any event, accident, or occurrence under the sun.

Some come with coverage for trip interruption, delays, rental cars, emergency medical care, and baggage theft, loss, or damage.

279photo Studio/Shutterstock

And then there are plans that begrudgingly refund you 50% of the cost of your trip in the event something unforeseen arises – if you get approved for a reimbursement at all.

This is why choosing the best travel insurance plan for your budget and needs is absolutely essential. Travel insurance isn’t something to skimp on!

Picking a bad plan could result in you not only paying for coverage, but still end up footing the bill for an unexpected issue on your trip.

If you’ve taken a dive into the complex world of travel insurance already, you know that settling on the best travel insurance plan is a lot harder than it sounds. There are just so many options to choose from!

That’s why we’ve collected cost, coverage, reviews, and plan option data from the top-rated travel insurance companies to bring you a list of the 3 best travel insurance plans.

Check out the 3 plans that came out on top in our analysis and make your selection from the best of the best.

3 Best Travel Insurance Plans

Whether you’re looking for the cheapest plan that offers good coverage or a premium plan with the most extensive, comprehensive coverage, we’ve got some goodies for you below.

We’ve ranked each plan according to the cost, coverage and protection, customer reviews, and extra options you can tack on for additional coverage.

Check out the 3 best travel insurance plans and what makes them stand out!

Best Travel Insurance Overall: Travel Guard Deluxe

- Affordability: 3/5

- Coverage: 5/5

- Reviews: 5/5

- Extras: 5/5

- Total: 18/20

Travel Guard Deluxe travel insurance is really the best you can get across all categories. It might be overkill for a quick, domestic trip – but then again, you can never have too much protection and coverage!

You’re covered for up to $150,000 in trip cancellation and they’ll pay up to 150% of the total trip cost (plus $1,000 for your return flight) if your trip is interrupted due to illness, injury, or death.

They’ll even reimburse you up to $2,500 if your flight is bumped up sooner due to inclement weather. Get up to $1,000 if your trip is delayed or pushed back by more than 3 hours.

You can add-on Cancel For Any Reason coverage for an additional cost (around 2%-4% of your trip cost) to get full cancellation coverage if you decide to cancel for a reason that’s usually not covered.

Baggage need not be a worry with this plan since they cover up to $2,500 if yours turns up missing, stolen, or damaged. You’ll get $500 if your baggage is delayed more than 12 hours!

Where this plan really shines is its broad-ranging emergency medical coverage. With up to $100,000 of travel medical coverage, this is the ideal plan for people traveling abroad or on cruises.

There’s even an extra $500 in dental coverage that most plans don’t offer. Flight Guard ($100,000) coverage kicks in in the event of a plane crash that results in death or dismemberment.

At a cost on the higher end of average, this insurance plan will cost you around 7% of the total cost of your trip. For our 2-week, $4,000 trip with a 46-year old traveler example, you might pay around $280 for this plan.

But with full, comprehensive coverage and tons of extras, this travel insurance plan is more than worth the cost. Customers rate it highly, from 4-5 stars typically, and the Better Business Bureau gives it an A+ rating.

Best International Travel Insurance: Travel Insured Worldwide Trip Protector

Source: travelinsured.com

- Affordability: 4/5

- Coverage: 4/5

- Reviews: 4/5

- Extras: 4/5

- Total: 16/20

Travel Insured Worldwide Trip Protector is an excellent, comprehensive travel insurance plan for anyone traveling abroad.

International trips need more medical coverage, Cancel For Any Reason protection, and coverage for travel delays and interruptions. Worldwide Trip Protector offers all of this!

At around $230 for an average 2-week, $4,000 trip with a 46-year old traveler, this is a mid- to high-tier plan with good coverage.

You could see even lower costs if your trip is shorter, your trip costs are lower, or you’re younger than 46. The plan rate is a little over 5% of the total trip cost, which is on the lower end of average for travel insurance.

You’ll get up to 100% of your trip cost reimbursed if it’s canceled for a covered reason, or 150% of the cost reimbursed if you’re forced to cut your trip short for just about any reason.

Unavoidable travel delays don’t need to dismay you, since you’ll get up to $1,000 ($200 per day) for any unused amenities, hotel stays, and meals. Up to $500 is covered for missed connections.

Missing, stolen, or lost baggage isn’t as big of a deal with this plan to protect you. You’ll get up to $1,000 for lost baggage or $300 to cover your expenses for delayed baggage.

If you’re a seasoned traveler using reward points or earned miles, they’ll even reimburse you up to $250 for penalties incurred for reinstating points from a cancelled trip.

Where this plan shines is the included medical coverage, up to $100,000 for accidents and illnesses. They’ll cover up to $1,000,000 for medical evacuation to a high-standard medical hospital or back to the U.S.

If the unthinkable happens and your remains need to be repatriated to the U.S., this plan also covers you with an additional $10,000 in coverage for accidental death or dismemberment.

You can optionally add-on more Accidental Death and Dismemberment coverage, Cancel For Any Reason coverage, rental car damage coverage, and benefit upgrades that double the payouts.

This plan gets great ratings from customers, mostly 4 and 5 stars, and the Better Business Bureau gives it an A- rating.

Best Domestic Travel Insurance: Allianz OneTrip Prime

- Affordability: 4/5

- Coverage: 4/5

- Reviews: 4/5

- Extras: 3/5

- Total: 15/20

Allianz OneTrip Prime is a comprehensive travel insurance plan with $100,000 in trip protection coverage, $150,000 in trip interruption coverage, and $50,000 in emergency medical coverage.

This plan is considered mid-tier, with costs around $215 based on a 2-week, $4,000 trip with a 46-year old traveler. If you’re younger, taking a shorter trip, or spending less on your trip, your costs will be even lower.

The medical coverage here leaves a little to be desired for long or international travel ($50,000 with $750 in dental coverage), but it’s great for domestic and shorter trips.

You’ll get covered for up to $500,000 for medical transportation while you’re on your trip, which is great for peace of mind. No one wants to get stuck with sky-high medevac or ambulance bills!

Get reimbursed up to $500 if you need to change your flight, cruise, train, or tour for a covered reason. Trip delays outside of your control land you up to $800, or $200 per covered traveler, per day.

Worry less about missing, damaged, or stolen baggage since it’s covered up to $1,000. You’ll get a $300 stipend to cover temporary expenses if your baggage is just delayed.

You can add-on Cancel For Any Reason coverage for an additional cost, as well as rental car insurance and pre-existing medical condition protection. These are great bonus features!

Customers really like the automatic SmartBenefits® daily payment of $100 per person, per day if delays happen with your baggage or trip. Allianz monitors flight delays to ensure you get your payment automatically.

This plan covers kids under 17 for free when traveling with a parent or grandparent.

At around $215 for an average 2-week trip, this is the best travel insurance plan for domestic travel and shorter international trips.

What it lacks in medical coverage, it makes up for with excellent trip protection and cancellation reimbursement. Plus, it gets mostly 4+ star reviews from customers and an A+ rating from the Better Business Bureau.

What’s the Best Travel Insurance Plan for Your Trip?

DUANGJAN J/Shutterstock

With the 3 best travel insurance plans laid out, how can you narrow your options down to find the single best plan for your specific trip needs?

Someone taking a 2-week international trip will likely need different coverage than someone visiting a destination closer to home.

Likewise, your overall budget and need for extras, like medical and Cancel For Any Reason coverage, will affect which plans are tailored to fit your trip.

Take a look at these considerations to see which travel insurance plan will best suit your needs and goals.

What’s Your Budget?

Your travel budget is the first thing to consider when choosing the best travel insurance. Most travel insurance costs somewhere between 4% and 12% of the total trip cost.

If you’re already spending a good chunk of change on your trip, there’s no reason to skimp on travel insurance – it’ll help ensure you get fully reimbursed with expenses covered if something goes wrong.

The Travel Guard Deluxe plan is ideal if you want the best of the best travel coverage.

If you’re taking a cheaper trip and spending less than $4,000 overall, you may look into lower-priced mid-tier plan with good coverage (like the Allianz OneTrip Prime plan) to keep things budget-friendly.

Where Are You Going?

If you’re visiting a distant country abroad, you’ll need more extensive travel insurance than if you’re traveling domestically.

The Travel Guard Deluxe plan is ideal for all international and domestic travel with the best coverage we found from any travel insurance plan.

The Travel Insured Worldwide Protector plan is perfect for shorter international travel and longer domestic trips.

Domestic travels mean you won’t need extra coverage for medical evacuation and repatriation in the event of an accident, so opting for the Allianz OneTrip Prime plan would suit your needs here.

How Much Medical Coverage Do You Want?

Medical coverage is a good differentiating factor for different travel insurance plans. If you have pre-existing conditions, are older, or just want more peace of mind, opt for a plan with enhanced medical coverage.

From our list of the best travel insurance plans, Allianz OneTrip Prime offers the least amount of medical coverage (up to $50,000 with $750 in dental coverage).

Better options for great medical coverage are the Travel Guard Deluxe plan and the Travel Insured Worldwide Protector plan.

The Travel Insured Worldwide Protector plan actually offers the best medical coverage. You get $100,000 in medical coverage with up to $1,000,000 for medevac and $10,000 for accidental death/dismemberment requiring return of remains to the U.S.

The Travel Guard Deluxe plan’s medical coverage is almost as good with $100,000 in emergency medical coverage, $100,000 Flight Guard coverage for plane crash accidental death or dismemberment, and $500 for dental coverage.

How Much Flexibility Do You Need?

Your trip’s level of flexibility matters when you’re choosing travel insurance. How likely are you to cancel or change your trip before departure? Do you need extra wiggle room to keep your options open?

Look for a plan with Cancel For Any Reason (CFAR) add-on options if you need that flexibility. All 3 of the plans on our list offer it for a small additional cost ranging from 2% to 4% of the total trip cost.

Check the fine print to see how each insurance plan handles cancellation, trip interruption, and delayed trips. Travel Guard Deluxe offers the most flexibility and even reimburses you up to $150,000 for trip interruptions.

So, What’s the Overall Best Travel Insurance?

Everyone’s travel needs are different, but the overall best travel insurance that will suit and exceed most peoples’ travel needs is the Travel Guard Deluxe plan.

It offers superior, comprehensive travel coverage for trip protection, cancellation, delays, interruptions, and medical/dental expenses. You’ll find that the cost is well within average, though on the higher end.

If something can wrong on a trip, Travel Guard Deluxe insurance will likely cover it. And if it’s not already included in the plan, you’ll have the option to add it on – like rental car damage or Cancel For Any Reason coverage.

You’ll be more than satisfied with this travel insurance plan, but Travel Insured Worldwide Protector and Allianz OneTrip Prime also made the best travel insurance list for a reason.

These plans are priced lower than the Travel Guard Deluxe plan and still offer broad-ranging coverage for trip cancellation, delays, lost or stolen baggage, emergency medical care, and more.

Whether you decide to go with the best of the best or opt for a more budget-friendly plan that still suits your needs for the trip, you can’t go wrong when you choose one of the best travel insurance plans from our list.