See our top 5 picks for the best travel credit cards that earn you points for travel discounts for purchases you’re already making. We explore the fees, rewards, intro offers, and more below.

What Are the Best Travel Credit Cards?

- Best travel credit cards offer points/miles for all purchases

- Earn points and redeem for travel expenses, gift cards, or cash

- Look for extra perks and discounts through your card

World travelers, wanderlust warriors, and eager sightseers: If you’re not already using a travel credit card, you’re missing out on big perks and bonuses.

Travel credit cards are designed to help you earn points, miles, or cash back on purchases you make related to travel – flights, hotel rooms, rental cars, train tickets, you name it.

But only the best travel credit cards will give you points and rewards for regular purchases, like streaming services, gas, and dining.

You’re already spending money on these things. Why not earn points toward travel with every single purchase?

We’ve found that the top travel credit cards offer you a great return on your investment, with annual fees as low as $0 and introductory offers with thousands of free points or bonus cash back to entice you to open up a card.

Earning points or rewards with any of the best travel credit cards makes it easy to redeem them for discounts on your travel expenses, like flights, hotels, rental cars, and more.

You’ll see cards on our list with bonus perks beyond the usual, like lounge access at airports across the globe, free trip cancellation/interruption insurance, and statement credits for select hotel stays and services.

If travel is a big part of your life or you just want to start earning points toward travel with everyday purchases, you need to use one of the best travel credit cards.

Take a look at our detailed list with ratings and perks for each below!

The 5 Best Travel Credit Cards, Ranked

Check out our list of the 5 best travel credit cards you can get, ranked by the most critical factors like rewards offered, annual fee, introductory offers for signing up, and Annual Percentage Rate (APR).

The cards that came out on top in our list are:

| Best for... | Our Top Picks |

|---|---|

| Best Overall | Capital One Venture Rewards |

| Best for Flexible Spending | Chase Sapphire Preferred |

| Best for Unlimited Rewards | Wells Fargo Autograph |

| Best for No Annual Fee | Chase Freedom Unlimited |

| Best for No Annual Fee | American Express Platinum |

We’ll dive into more detail and show you the highlights, pros, and cons of each of the best travel credit cards below. Which one lines up with your travel goals and spending habits?

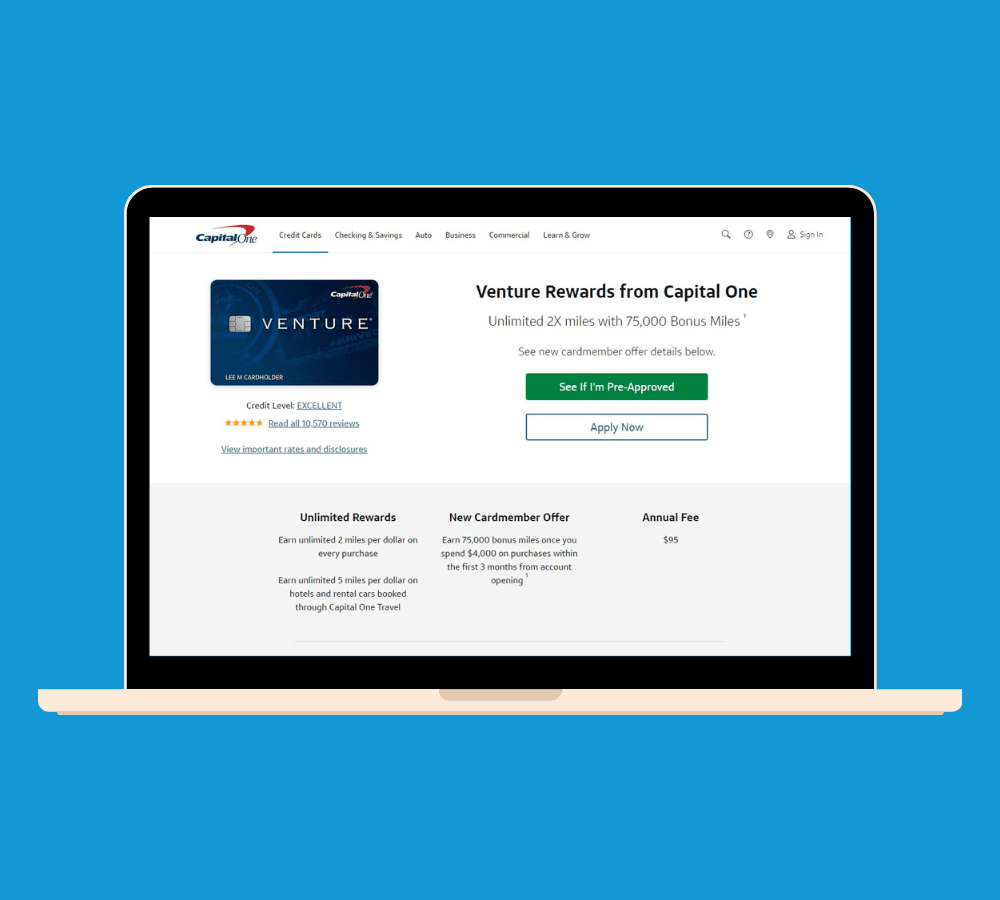

1. Best Overall: Capital One Venture Rewards

If you’re overwhelmed by all the travel credit card choices out there and just want to make sure you sign up for the best while keeping things simple, go with Capital One Venture Rewards.

This happens to be the card I use for both personal and business uses. Yes, I love it that much. Not only do I love the flexibility and variety of uses for points, but the little perks like reimbursement for TSA pre-check are nice touches.

It earns an excellent 19/20 rating on our scale – almost perfect and an excellent choice for every type of traveler.

This card makes earning points and miles easy with a flat rewards rate whether you’re using it to pay for airfare and hotels or just to pick up the bill at the gas station or grocery store.

You’ll earn 2 miles per dollar spent on every purchase without limits on miles you can earn. These miles apply to any travel purchase made in the last 90 days – something you don’t often find with travel cards.

Planning on heading out of the country? Enjoy zero foreign transaction fees with this card. The annual fee of $95 is average for travel credit cards and this one comes with a lot of perks.

But if you want trip cancellation/interruption insurance from your travel credit card, go with the Capital One Venture X Rewards card instead.

This one offers trip accident coverage up to $250,000 and lost/stolen luggage reimbursement up to $3,000.

Redeem your points and miles as statement credits for airfare, hotel stays, rental cars, and more. You’ll even get 2 free Capital One lounge access passes each year!

A hefty intro offer of 75,000 miles makes this travel credit card ultra-tempting, but note that you’ll have to meet the minimum $4,000 spending requirement within 3 months of opening your card.

That’s relatively easy to do if you’re planning on paying for an upcoming trip with the card – and you’ll get your 75,000 bonus miles as soon as you meet the spending threshold.

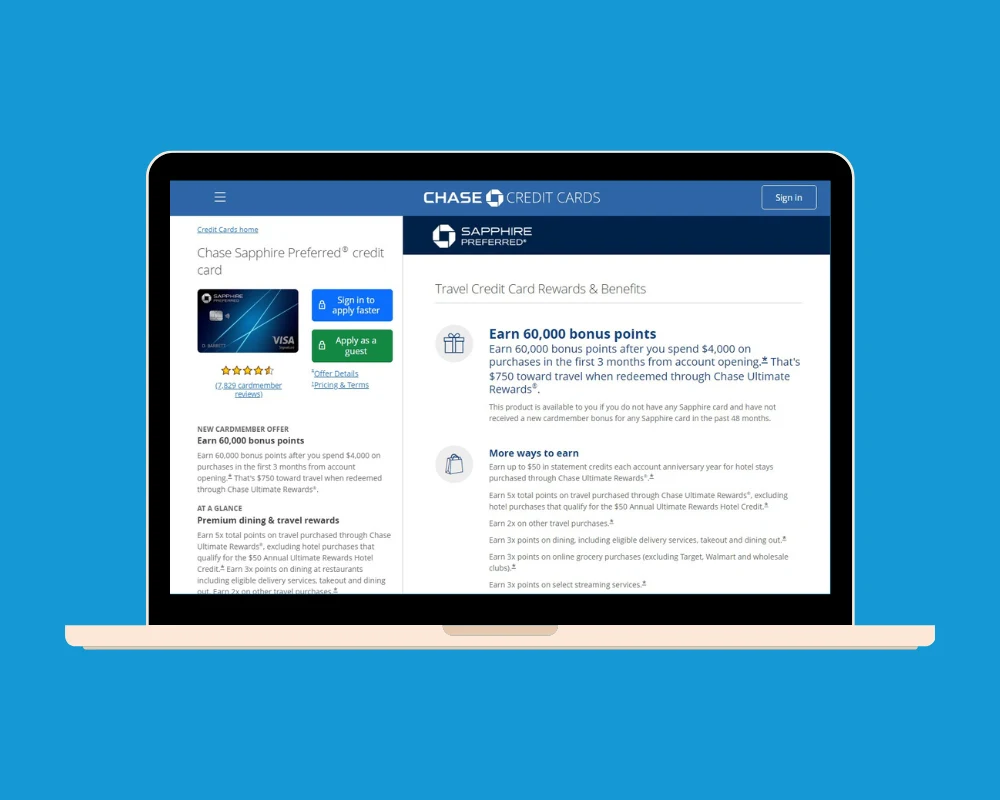

2. Best for Flexible Spending: Chase Sapphire Preferred

The Chase Sapphire Preferred travel credit card ranks second on our list and is the best card for flexible spending. This card earns a solid 17/20 points on our rating system and users love the perks it offers.

You’ll earn the most on travel purchased through Chase Ultimate Rewards and Lyft rides (5X points), 3X points on dining, streaming services, and online grocery purchases, and 1 point per $1 spent on everything else.

Enjoy a free $50 annual hotel credit, 6 months of InstaCart+ and DashPass, and an included, robust trip cancellation/interruption travel insurance plan for peace of mind wherever you go.

Plus, did you see the amazing 60,000 points intro offer? It kicks in after you’ve spent $4,000 within the first 3 months of opening the card.

When you redeem those 60K points through Chase Ultimate Rewards, it’s the same as $750 for airfare and hotels or $600 cash.

You won’t directly earn perks for travel like free checked bags or free hotel stays, but this is the best travel credit card for flexible spending. It earns you points toward travel with your regular expenses and purchases.

For the $95 annual fee, you’re getting a lot of benefits and earning potential with every purchase you make – even non-travel expenses, though you’ll earn less (1X) for these.

Users find the Ultimate Rewards portal easy to use and we like how it makes viewing and redeeming your rewards simple. You can even redeem points for cash (1.25 cents/point)!

Just be sure to make your payments on time with the Chase Sapphire Preferred. The penalty APR is 29.99% for late payments, a penalty that may not fall off your account after one or more late payments.

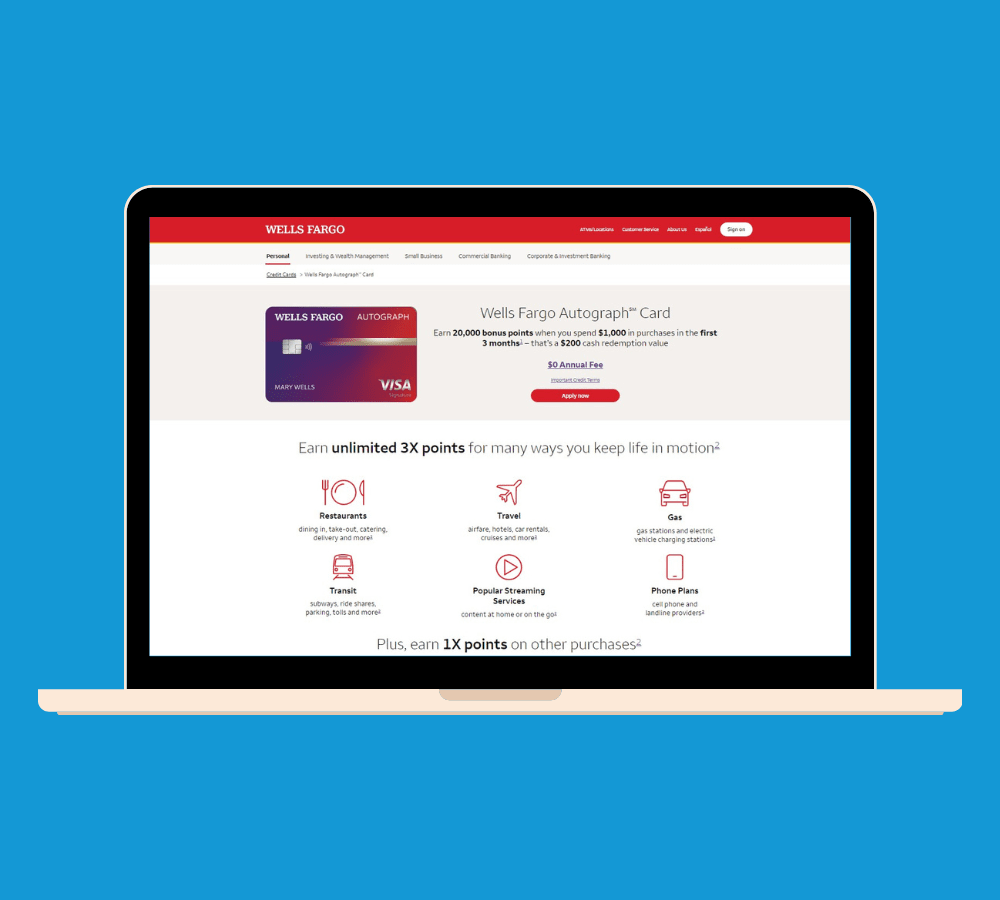

3. Best for Unlimited Points: Wells Fargo Autograph

Want to accumulate as many points as possible with every purchase you make to make travel more affordable when the time comes? Check out the Wells Fargo Autograph travel credit card.

With a great rating of 16/20 with all criteria considered, this is the ideal card for someone who wants to avoid annual fees while earning unlimited points toward travel.

The “barrier to entry” is much lower with this card to get the nice intro offer of 20,000 points – spend $1,000 during the first 3 months to unlock the offer and get the equivalent of $200 cash redemption.

New users really love the 0% introductory APR for the first 12 months! After that, the rate is 19.49% to 29.49%.

We recommend this card for people with a good to excellent credit score since the APR can be high for poor credit scores.

You’ll earn 3X points on travel, restaurants, gas, streaming services, phone plans, and more. All other purchases earn you 1X points (1 point per dollar spent).

Redeem your accumulated points for travel (flights, car rentals, and hotel stays), gift cards, or purchases to save money in the way that benefits you best.

Extra perks include roadside assistance, rental car damage waiver, and emergency cash advances in the event your card is stolen or lost.

Note that the entry-level Autograph card is a little different from a traditional travel credit card.

You won’t be able to use it to transfer your earned points directly to airlines or hotel loyalty programs – only to redeem for travel, gift cards, or purchase discounts.

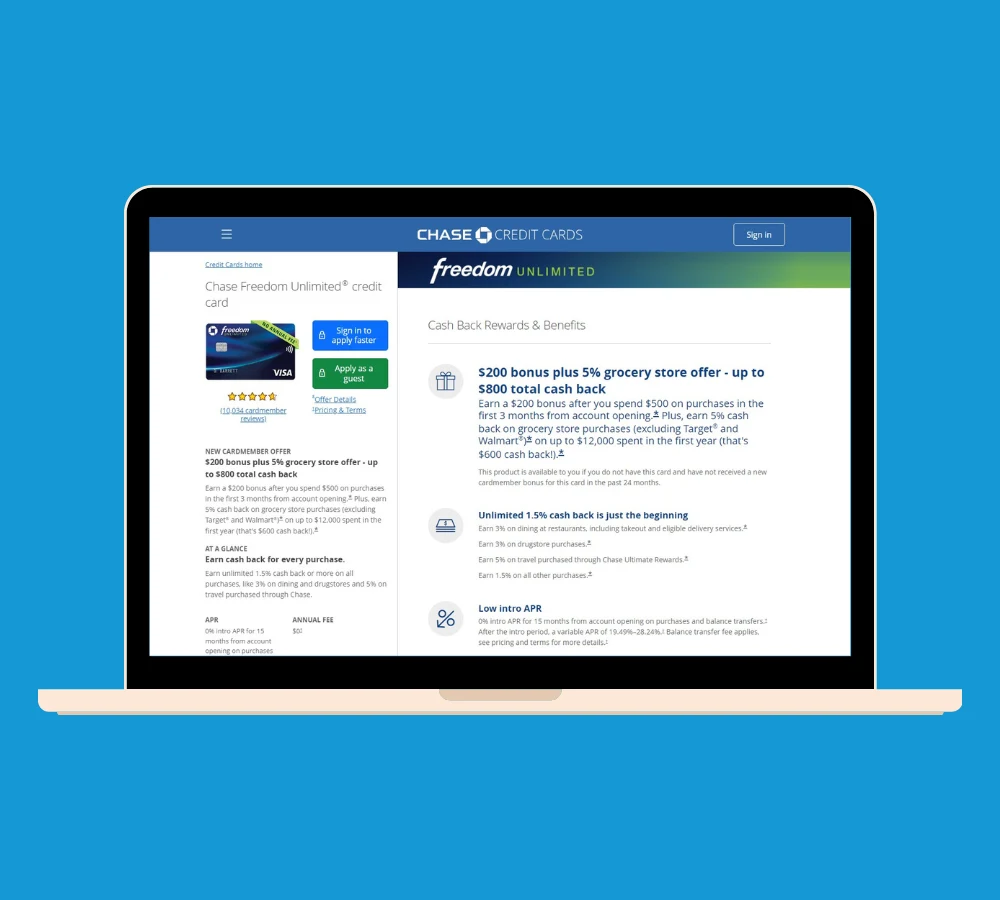

4. Best for No Annual Fee: Chase Freedom Unlimited

Chase Freedom Unlimited is one of the best travel credit cards we’ve found and it tops the list for travel cards with no annual fee, earning 15 out of 20 possible points on our scale.

The intro offer is equivalent to $300 cash back thanks to the extra 1.5% cash back (up to $20,000) you’ll earn using this card during the first 12 months.

That means if a purchase usually earns you 3% cash back, you’ll actually earn 4.5% on it during your first year. It adds up, but it’s not the best intro offer we’ve seen from travel credit cards.

This card earns you up to 6.5% cash back (5% after year 1) on purchases made through Chase Ultimate Rewards. Get 4.5% cash back (3% after year 1) on dining, delivery services, and drugstore purchases.

You’ll always earn 1.5% cash back on all other purchases, but that translates to 3% during your first year with the card. Talk about a great deal – and all with no annual fee.

The variable APR up to 28.24% can be a killer if you carry a balance on this card, but users appreciate the 0% introductory APR for the first 15 months.

There’s no minimum amount of rewards you need to redeem for cash back and the rewards will never expire. That means you can roll all your rewards over to make a big dent in your next travel purchase!

We especially like the included trip cancellation/interruption insurance that covers up to $6,000 per trip ($1,500 per person) on nonrefundable travel you must cancel or interrupt for unforeseeable reasons.

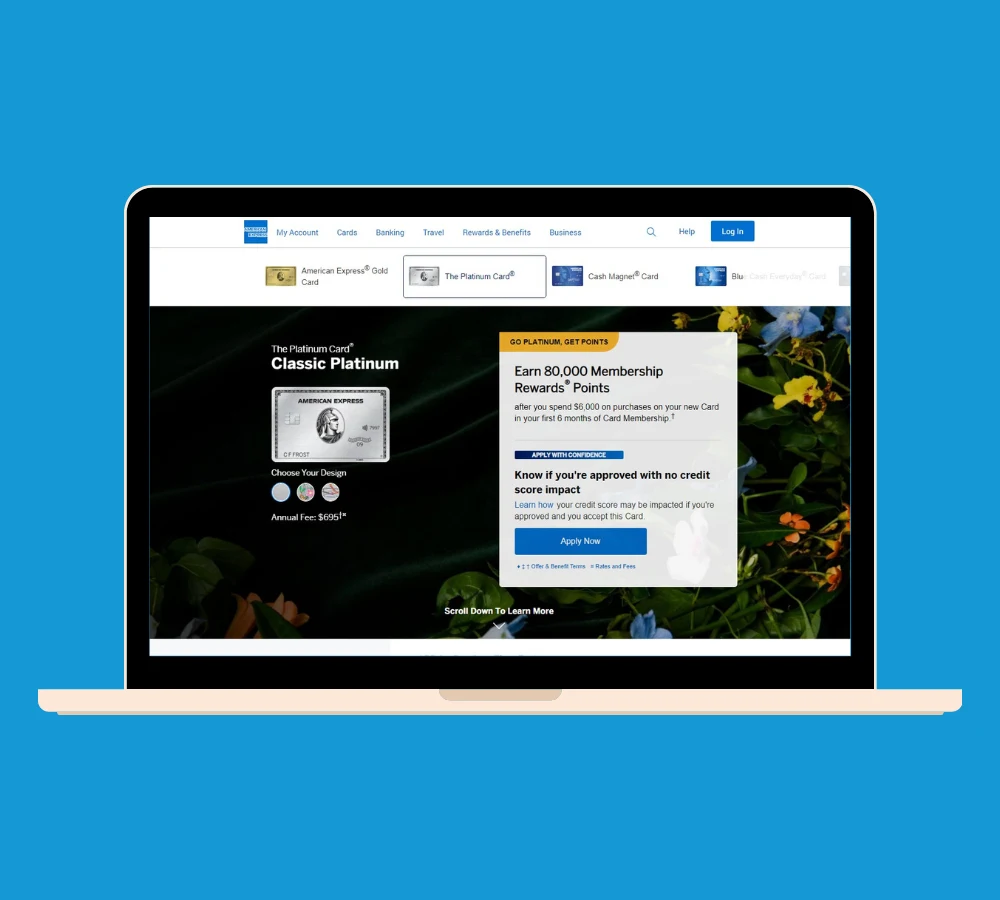

5. Best for Luxury Travel: The American Express Platinum Card

If you prefer the finer things in life and take luxury trips that get a bit spendy, The Platinum Card from American Express is the best travel credit card for you.

The Platinum Card earns 14/20 points on our scale due to the hefty annual fee (almost $700) and relatively high variable APR (up to 27.49%).

But with that big annual fee, you’re getting a lot of benefits, rewards, and perks that can make luxury travel even more satisfying and simple.

The intro offer of 80,000 Membership Rewards Points applies once you spend $6,000 within the first 6 months of opening the card. If you’re traveling in luxury, that won’t be hard to hit.

Earn 5X points on flights booked directly with the airline or through AmExTravel.com and 5X on hotels booked through AmExTravel.com. You’ll get 1X points for all other purchases.

You’ll get a $200 hotel statement credit on select prepaid hotel stays, up to $200 airline credits annually, $20/month for digital streaming services, free Walmart+, and $15 monthly credits for Uber Eats.

In fact, there are so many perks and benefits from freebies to cash back and statement credits for different types of purchases that it can be a challenge to figure it all out.

The difficulty of figuring out the robust rewards program lowered our rating a bit, but the value of these perks is a clear benefit to using this card.

Best Travel Credit Card Features and Perks

Still not sure which is the best travel credit card for your specific needs?

Here are the top 3 things you should look for and which travel credit cards offer these perks.

Travel Insurance

- Chase Sapphire Preferred (up to $10k/trip)

- Chase Freedom Unlimited (up to $6k/trip)

- The Platinum Card from American Express (up to $10k/trip)

If something comes up and your plans for your upcoming or current trip are thrown for a loop, you’ll be glad to have one of the best travel credit cards with travel insurance – trip cancellation, interruption, and delay insurance.

Chase Sapphire Preferred offers $5,000 per trip (up to $10,000/year) per person or $10,000/trip (up to $20,000/year) for group trip cancellation or trip interruption.

You’ll get up to $500/ticket for unexpected trip delays of at least 12 hours. Delayed baggage gives you $100/day, up to $500. You’ll also get up to $3,000 for lost or stolen luggage.

Chase Freedom Unlimited offers a less robust travel insurance plan with up to $6,000 for a cancelled or interrupted nonrefundable trip (or $1,500 per person) that occurs due to unforeseen reasons.

For the $0 annual fee, this feels like a generous perk and it’s easy to supplement with better travel insurance if you need it.

The Platinum Card by American Express offers similar trip cancellation and interruption insurance as the Chase Sapphire Preferred card, with up to $10,000 in coverage per cancelled or interrupted nonrefundable trip.

You can get up to $20,000 per card annually for trip cancellation/interruption coverage as long as you booked with the card. Trip delays reimburse you up to $500/ticket if you’re delayed more than 6 hours.

Low or No Annual Fee

- Capital One Venture Rewards ($95)

- Chase Sapphire Preferred ($95)

- Wells Fargo Autograph ($0)

- Chase Freedom Unlimited ($0)

Most of the travel cards on our list have a low annual fee or no annual fee, making them great entry-level cards if you’re just starting out with earning points toward travel.

Capital One Venture Rewards and Chase Sapphire Preferred both have a $95 annual fee, which you’ll easily recoup in points, benefits, and perks earned throughout the year.

Wells Fargo Autograph and Chase Freedom Unlimited cards have no annual fee. You won’t pay anything to use them, just interest after the initial 12-15 month 0% APR period.

This makes both Autograph and Freedom Unlimited cards a great idea for cardholders who just want to give travel credit cards a try without paying anything in return – just earning sweet, sweet points and miles!

Steer clear of The Platinum Card by AmEx if you’re looking for a low or no annual fee structure – the annual fee is $695, and while it’s well worth it with all the perks included, it’s not the best for new travel cardholders.

Robust Perks and Benefits

- The Platinum Card by American Express

- Capital One Venture Rewards

- Chase Sapphire Preferred

- Chase Freedom Unlimited

- Wells Fargo Autograph

Every travel card on our list of the 5 best will earn you robust perks and benefits, but they all stack up differently.

The Platinum Card by American Express offers the most benefits and earning potential, but it also has the highest annual fee ($695). From free premium rental car upgrades to $200 hotel fee statement credits, you get a lot of freebies and discounts with this card.

Capital One Venture Rewards offers tons of perks and benefits, including 2 miles for every $1 spent with no limits on earnings, $100 towards your TSA PreCheck or Global Entry fee, free rental car insurance, and trip accident coverage with $3k baggage reimbursement.

Chase Sapphire Preferred offers incredible perks and benefits, from trip cancellation coverage to $50 hotel credits annually and 6 months of free Instacart+ and DashPass.

Chase Freedom Unlimited surprisingly offers a wide range of bonus perks and extras as a travel credit card with no annual fee. Cash back on every single purchase (up to 6.5%) and included trip cancellation insurance makes it our third pick for perks and benefits.

Wells Fargo Autograph offers lots of great benefits, but they may not be as exciting as the other cards. Get up to $600 cell phone reimbursement insurance, rental car insurance, roadside dispatch, and emergency cash advances with this card.

So, What Are the Best Travel Credit Cards?

The best travel cards earn you points on regular and travel-related purchases so you can turn those expenses into discounts for future trips.

From earning one point per dollar spent to 5X points or 6.5% cash back on each purchase, this list of the best travel credit cards should help you pinpoint the card that best suits your needs.

Overall, you can’t go wrong with Capital One Venture Rewards card – the best of the best and one of the top rated cards in terms of rewards, annual fee, and perks.

Don’t sleep on Chase Sapphire Preferred, the best travel card for flexible spending on purchases from groceries to gas. Travel insurance, rental car insurance, and statement credits for expenses make it worthwhile.

The Wells Fargo Autograph card is an excellent choice for anyone who wants to earn unlimited rewards and points, rental car insurance, and up to 3X points on purchases all with no annual fee.

Check out Chase Freedom Unlimited for a no annual fee card that supplies you with plenty of points-earning potential and benefits like trip cancellation and interruption insurance!

For true luxury travelers, The Platinum Card by American Express is the best choice. It has a higher annual fee, but comes with so many perks and freebies, it’s well worth it.

Points earning is easy and you’ll quickly earn discounts on travel by racking up points right from signup with the introductory offers each one of these travel cards offers.

Go ahead – make your next trip a little less expensive and more enjoyable by opening one of the best travel credit cards and earning points off every purchase you make.

You’ll be so glad you did when you’re taking advantage of the free perks and discounted rates on travel!